The Essential Guide to Invoice Templates: What Every Small Business Owner Needs to Know

As a small business owner, you're likely wearing many hats. One of the most important, yet often overlooked, is that of an accountant. Invoicing is a crucial part of your business's financial health. It's how you get paid for your products or services. But if you're new to the business world, you might be wondering, "What is an invoice, and how do I create one?" This is where invoice templates come in. Invoices play a crucial role in the financial health and professional image of small businesses. Whether you're freelancing or operating a company, understanding the basics of invoicing can save you time, ensure timely payments, and promote smooth financial transactions. Let's delve into the world of invoice templates and uncover everything you need to know.

However, creating an invoice from scratch every time can be tedious, error-prone, and counterproductive. This is where invoice templates come into play. These pre-designed frameworks not only save precious time but also standardize the billing process, ensuring every client interaction is consistent and professional. As we journey ahead, we will explore the nuances of these templates, offering insights and guidelines, ensuring that every small business owner is well-equipped to navigate the intricacies of effective invoicing.

What is an Invoice?

So, let's start with the basics. What is an invoice? An invoice is a bill or a request for payment sent by a supplier to a buyer for the goods or services provided. It’s an essential document used in business transactions and typically includes details such as what the customer has bought, how much they need to pay, the due date for payment, and various other important details.

Now you might be wondering, 'Isn't that just like a receipt?' Well, not exactly. Although invoices and receipts are used in financial transactions, they have distinct roles and serve different purposes.

An invoice is issued before the payment is made as a way to request payment, while a receipt is issued after the payment as proof of the transaction. Think of an invoice as a detailed 'bill' you give your customers, while a receipt is their proof of payment for that bill.

Which Elements are Necessary in an Invoice?

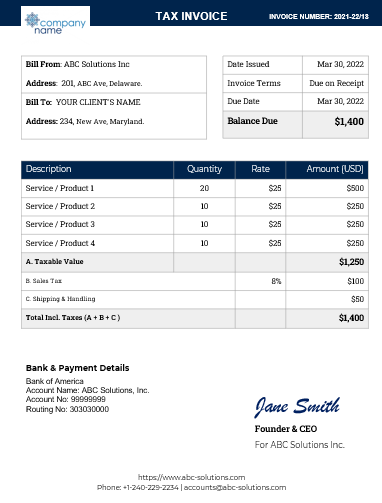

1. Branding: Company Logo or Name Your invoice should start with a clear representation of your business. This can be in the form of a well-placed logo, which not only establishes the invoice's origin but also reinforces your brand image. If you don’t have a logo, simply positioning your company or personal name prominently works too.

2. Unique Identification: Invoice Number Every invoice needs a unique identifier, making tracking easier and more efficient. A common practice is to combine the financial year with a sequential number, like "22-23/01". This method ensures both clarity on when the invoice was issued and a unique identification number.

3. Origin Details: Bill From Name & Address Whether you're a sole proprietor or an established business, clearly mentioning the issuer's name and address is paramount. This information tells the recipient who the bill is coming from and provides essential contact details.

4. Recipient Specifics: Issued To Name & Address It's crucial to clearly state the recipient's details, ensuring that the invoice reaches the right hands. If services or products are rendered at a different location, the "Ship to" field captures that information.

5. Timing: Date Issued Highlighting the issuance date helps set the timeline for expected payment, especially when considering the invoice terms that follow.

6. Payment Guidelines: Invoice Terms Setting clear terms, like "Pay on Receipt" or "Within 30 Days," gives the recipient clarity on the expected timeline for payment, ensuring there's no ambiguity.

7. Deadline: Due Date Directly tied to the invoice terms, the due date underscores the final day by which payment should be made, acting as a clear reminder for the recipient.

8. Owing Amount: Balance Due This is a pivotal section, clearly showcasing the total amount expected from the recipient, derived from the individual service or product charges.

9. Itemization: Description, Quantity, and Rate A detailed breakdown of services or products provided gives the recipient a clear picture of what they are being charged for. Whether it's "Artistic Wall Painting" or hourly "IT Support Services," mentioning the quantity and respective rate offers full transparency.

10. Amount By multiplying the rate by quantity (or hours), the total for each service or product is determined, feeding into the overall balance due.

11. Additional Costs and Total: Taxable Value, Sales Tax, Shipping & Handling, and Total Any taxable amounts, sales taxes, and additional charges like shipping are clearly stated, ensuring no hidden costs. The culmination of these gives the final invoice amount, which is prominently displayed.

12. Payment Methods: Bank Details In today's digital age, offering multiple payment options can expedite the payment process. By listing bank details and other platforms like PayPal or Venmo, you provide the recipient with flexibility and convenience.

13. Signature A signature, even if it's just your name in the designated block, adds a personal touch and authenticates the document.

14. Additional Points of Contact: Supplemental information, like your website, phone number, or email, ensures that if there are any discrepancies or queries regarding the invoice, the recipient knows exactly how to reach you.

How to Use Invoice Templates Effectively?

1. Simplicity is Key: Invoicing can be a daunting task, especially when you're juggling multiple responsibilities as a business owner. The beauty of a good invoice template lies in its simplicity and effectiveness. With the right layout and fields, you're equipped to produce invoices that not only look professional but also facilitate timely payments. The hallmark of a successful invoice is clarity, accuracy, and a reflection of your business's dedication to professionalism.

2. Keep Diligent Records: Every invoice sent should be meticulously stored either digitally or in physical form. This practice aids in monitoring payments, settling disputes, and preparing accurate financial statements. Moreover, maintaining such records can be a lifesaver during tax season or any financial audits.

3. Define Your Payment Terms: Payment terms shouldn’t be an afterthought. Clearly stating terms like "Due upon receipt" or "Net 30" provides your clients with a clear roadmap, encouraging timely settlements. Furthermore, specifying preferred payment methods, whether it's a bank transfer, credit card, or digital platform, further streamlines the process for your clients.

4. Clarity Above All: A vague description can lead to unnecessary back-and-forth communications, delays in payment, or even disputes. Ensure that each service or product listed has a comprehensive, yet concise, description, allowing clients to understand precisely what they're being billed for.

5. Personalize Your Template: While templates offer a standardized format, infusing them with your brand identity sets your invoices apart. Incorporate your company's logo, color scheme, and other branding elements to enhance recognition and exhibit professionalism.

6. Stay Compliant: Remember, invoices are more than just requests for payment; they're legal documents. Your invoice template should be equipped to incorporate all necessary components that align with local tax and business regulations.

7. Embrace Accuracy: One of the primary advantages of templates is their consistency. By having a set layout, you reduce the chances of omitting crucial information. Double-check each invoice for correct amounts, client details, and service descriptions to ensure accuracy.

8. Prioritize Efficiency: Time is a valuable commodity in business. Templates expedite the invoicing process, eliminating the need to build a document from the ground up. Over time, this saved effort accumulates, allowing you to focus on other pressing matters.

9. Exude Professionalism: Your invoice is an extension of your business. A well-structured, clean, and organized invoice not only makes the payment process easier but also sends a strong message about your commitment to excellence and professionalism. It communicates that you take every aspect of your business seriously – right down to the billing.

Incorporating these practices into your invoicing process ensures you maintain a balance between efficiency and professionalism, ultimately fostering trust with clients and promoting timely payments.